A groundbreaking financial model now recognizes something long known to traders. Investors are not always perfectly rational. They do not always wait for the mathematically ideal moment to exercise an American option. The new framework directly incorporates real-world human behavior, giving analysts a more accurate view of pricing and risk. This innovation arrives from researchers featured in China Finance Review International and represents a major shift in financial modeling.

The model uses a concept called an ϵ optimal exercise set. This means investors may exercise options not only at the ideal trigger point, but also within a zone where they still make a near optimal decision. It replicates what happens in markets. Some investors act early. Some act late. This behavior matters. The study builds tools and formulas to quantify it. Professionals now gain access to clearer insights into pricing, hedging, and risk planning.

How the New Pricing Framework Works

The methodology is built to improve both perpetual and finite maturity American options. It starts with what experts already know. In theory, there is an optimal boundary. Once the underlying asset hits this level, exercising the option makes the most sense. But in reality, psychology, fear, impatience, and risk tolerance change decisions.

This new approach calculates how far from the boundary a person might still take action. It defines that real-world zone. Then, it updates pricing models accordingly. The focus remains practical and fast enough for institutional systems. The researchers also introduce a numerical algorithm to help compute value changes when an asset price jumps near the exercise region.

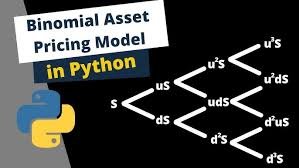

To make these results accessible to traders and analysts, the method is built in clear steps:

- Divide time from purchase to expiry into multiple nodes.

- Estimate the boundary at each node to maximize expected profits.

- Apply analytical formulas for European options to accelerate computation.

- Backward calculate each earlier boundary from the known maturity point.

- Identify the lowest asset price where exercising becomes the best choice.

Each step keeps the model grounded in how real pricing engines function. Yet it updates the logic to include psychology and risk comfort levels. This change helps banks and hedge funds manage real exposure instead of relying on a strict rational investor model.

Some investors exercise options early due to fear of missing out. Others hang on too long. These patterns have always existed. Now they finally have a place in pricing science.

Why This Research Matters to Financial Markets

This model offers three important advances at once. First, it adds behavior to pricing. Second, it supports both puts and calls. Third, it includes both perpetual and finite options. These features make the approach practical for real operations across equity, commodity, currency, and complex derivative desks.

Markets can move sharply near exercise levels. Traders need to estimate value shifts quickly. If only the theoretical boundary is used, pricing often misses reality. A more human model supports better hedging. It means stronger protection for both sides of a contract.

One section of the research uses the Crank Nicolson method. This is a trusted numerical technique in finance. It calculates price intervals rather than a single point. That type of range based view reflects actual uncertainty. Institutions want precise risk windows, not guesswork.

The findings also support risk managers. They can track how sensitive an option portfolio is to investor behavior. Fear spreads quickly in the market. A model that acknowledges this helps protect capital.

This framework creates a solid platform for the future. More behavioral features can be added. The industry could soon see option tools that account for panic selling, herd instincts, or asymmetric risk aversion. As behavioral finance grows, pricing models must adapt. This research takes a bold first step.

Key Contributions of the Study

The study highlights several major contributions that will influence academic and professional finance:

- Closed form formulas for perpetual American options with psychological behavior considered

- A complete numerical algorithm to approximate the ϵ optimal exercise zone

- Pricing tools that return value intervals and reduce estimation risk

- Integration of investor risk preferences directly in the exercise decision

- Practical solutions that allow smooth transition from theory to industry use

These enhancements can reduce mispricing in fast moving markets. They may also improve performance in portfolios exposed to volatility spikes, such as earnings announcements or commodity disruptions. Better pricing leads to clearer risk ownership between buyers and sellers.

Practical Use Cases for Traders and Risk Analysts

Professionals seeking clearer insights into the value and timing of American style options will find this framework useful. Below is a quick summary of practical applications.

| Use Case | How the New Model Helps | Who Benefits |

|---|---|---|

| Risk Pricing of Equity Options | Shows boundaries where early exercise may occur in real conditions | Investment banks and hedge funds |

| Derivative Valuation Near Expiry | Gives accurate value intervals, not a single point | Market makers and arbitrage desks |

| Behavioral Risk Assessment | Links emotional decisions to pricing outcomes | CRO teams and financial supervisors |

| Stress Testing | Improves scenario realism under panic selling | Risk modeling teams |

| Strategy Building | Tracks where sentiment might override optimal logic | Trading desk leaders |

These advantages become stronger when markets are unstable. In volatile environments, psychology moves faster than price models. Having robust structure that predicts behavioral shifts can reduce unplanned losses.

How the Approach Strengthens Real Market Behavior Models

Supporting Confidence in Market Pricing

Markets depend on confidence. Pricing must reflect how people truly act. When models assume perfect logic, mispricing becomes common. This research closes part of that gap. It makes pricing align with how decisions are actually made. People weigh fear and reward together. They react to news or expiration pressure. The new pricing logic respects that. It supports stronger hedging. It also reduces vulnerability during sudden shifts.

Enhancing Future Financial Innovation

This method sets a foundation for growth in behavioral derivative modeling. Future studies may refine ϵ optimal zones further. They may explore cultural differences, institutional mandates, or risk penalties. Technology can adapt fast. Financial engineering can now explore new forms of options that reward disciplined timing. The insights may influence automated trading and advisory systems. Better models mean safer markets.

Trending FAQ

What problem does this new American option model solve?

It corrects a long standing flaw. Traditional models assume all investors behave with perfect rational timing. The new approach includes behavior and risk preferences, improving accuracy.

Who developed this research?

The findings were published in China Finance Review International and supported by Shanghai Jiao Tong University Journal Center. It is a peer reviewed contribution to financial science.

Does this method work for both put and call options?

Yes. The model covers each type separately and builds formulas useful for both pricing and risk management.

Is the model ready for practical use?

Yes. It uses closed form formulas for perpetual cases and efficient numerical algorithms for options with maturity dates. Institutions can adapt it to existing systems.

Why does investor behavior matter in pricing?

Because fear and confidence change timing decisions. The real world includes early exercise or delayed exercise. Accounting for this leads to more reliable risk estimates.

This research offers a pivotal step forward for pricing American style options. By replacing strict rationality with a behavioral view, models now reflect reality more closely. For traders, analysts, and risk managers, this means sharper insights, fewer surprises, and tools designed for modern markets where psychology and price always move together.