Global financial markets reeled on Friday as escalating trade tensions between the United States and China sent stock indexes plummeting and investors scrambling for safe havens.

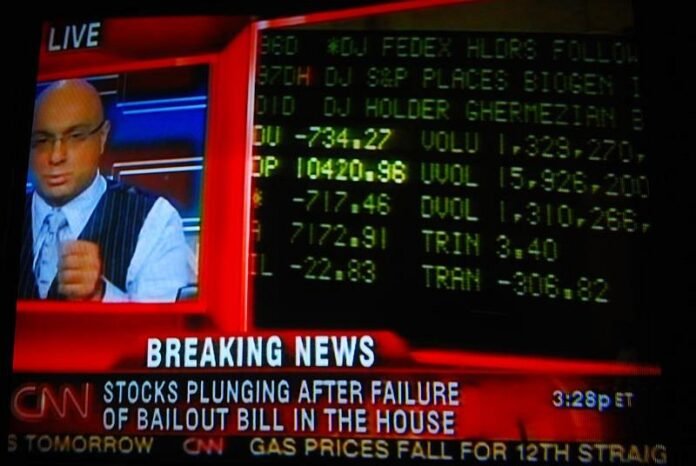

The Dow Jones Industrial Average plunged 2,054 points, marking one of the worst single-day sell-offs since the early days of the COVID-19 pandemic in 2020. The drop pushed the Nasdaq Composite into official bear market territory, defined by a fall of at least 20% from a recent high, while the S&P 500 saw companies lose over $US4 trillion ($6.5 trillion) in market value in just two days.

The market turmoil follows a sweeping announcement by President Donald Trump, who imposed steep new tariffs on dozens of countries, including a blanket 10% tariff on most U.S. imports. In retaliation, China unveiled its own 34% levy on American goods, stoking fears of a prolonged global trade war.

Global Ripple Effect

The fallout extended well beyond Wall Street. The pan-European STOXX 600 index tumbled into correction territory, and oil prices dropped to their lowest level since 2021. Key industrial commodities like copper also saw sharp declines, reflecting broader concerns that a worsening trade conflict could drag the global economy into recession.

READ MORE: Australian Superannuation Funds Hit by Cyber Attacks, With Members’ Money Stolen

“This is sort of the worst-case scenario for markets,” said Rick Meckler, a partner at Cherry Lane Investments. “Many assumed these tariffs were part of a negotiation tactic. Now, it’s getting deeper, more detailed, and significantly more dangerous for multinational companies.”

Markets initially showed signs of recovery following a strong U.S. jobs report released Friday morning, which revealed higher-than-expected hiring. But the data, considered backward-looking, did little to stem the growing anxiety over what lies ahead.

Trump Doubles Down

Despite the economic chaos, President Trump remained unapologetic. Shortly after announcing the tariffs, he was photographed arriving at Trump National Doral Golf Club in Florida, accompanied by his son Eric Trump. In a social media post, the president declared:

“THIS IS A GREAT TIME TO GET RICH.”

His remarks drew sharp criticism from political opponents and financial commentators, who pointed to the timing of his getaway while markets cratered and millions of Americans saw their retirement savings dwindle.

“While the American people are trying to put food on the table, I see that Donald Trump’s out playing golf,” said Senator Ben Ray Luján, a Democrat from New Mexico. Senate Majority Leader Chuck Schumer accused the president of being trapped in a “billionaire bubble” while average Americans suffer.

Economic Concerns Mount

The latest trade salvo between the world’s two largest economies has added to growing concerns that the current economic recovery could stall—or worse, collapse. Analysts warn that if tariffs remain in place for an extended period, the consequences could include:

- A sharp increase in consumer prices

- Slowing GDP growth

- A surge in inflationary pressures

- Potential recession in major economies

“The world has changed, and the economic conditions have changed,” said Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock. “The central question now is: will this trade war tip us into a global recession?”

Markets in Turmoil

- The S&P 500 suffered its worst two-day loss since March 2020, when the COVID-19 pandemic first gripped global markets.

- European stock indexes fell by approximately 5%, with Germany’s DAX and France’s CAC 40 among the hardest hit.

- Oil prices dipped to their lowest levels in over three years, further fueling concerns about slowing global demand.

- Safe-haven assets, including U.S. Treasury bonds and gold, saw increased interest from investors.

Even before the latest developments, economists had been sounding alarms about the fragility of the global economy. The added uncertainty of a full-scale trade war is expected to depress business investment, disrupt supply chains, and reduce export demand.

Looking Ahead

Despite strong labor market data, sentiment among investors remains grim. With more than $US4 trillion erased from the market in 48 hours, confidence in the economic outlook is faltering.

Some analysts believe that unless either side pulls back or negotiates a truce, markets could continue to decline.

“This is no longer just about tariffs—it’s about long-term strategy, trust, and the reshaping of the global economic order,” said Anne Becker, senior market analyst at Morgan & Ellis. “Until there’s clarity or de-escalation, expect volatility to remain high.”

As Americans brace for higher consumer prices and the prospect of recession, global leaders are watching closely. For now, the world’s economic future hangs in the balance—and the next move belongs to Washington and Beijing.