The Australian share market has endured its most punishing day since the pandemic, with the benchmark S&P/ASX 200 shedding more than 4% on Monday, 7 April 2025. The dramatic plunge erased over $100 billion in value from Australian equities, dragging the index down to 7,343 points—its lowest level since December 2023.

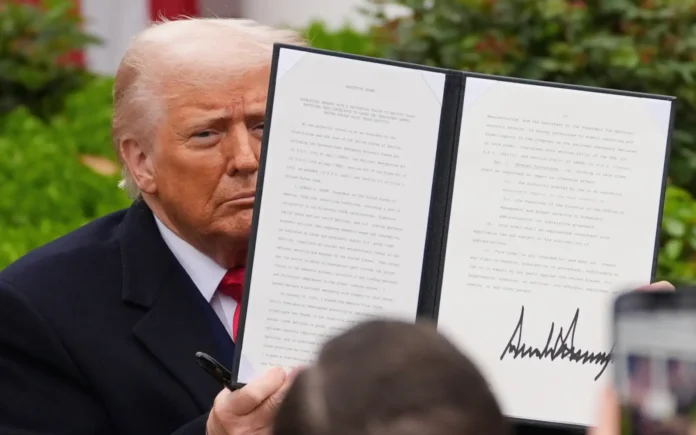

The catalyst? A fresh wave of global trade tension sparked by former U.S. President Donald Trump’s “Liberation Day” tariff plan, which has rattled global markets and prompted fears of a full-blown recession.

A Market Meltdown on Par with Historic Crashes

Monday’s collapse places the trading session in a rare and ominous league of market declines that include the COVID-19 crash in 2020, the 2008 global financial crisis, and the infamous 1987 stock market crash.

READ MORE: Two-Faced Cities: Australia’s Rental Crisis is Dividing the Nation

“It’s a bloodbath on the share market today in Australia,” said Luke McMillan, head of research at Ophir Asset Management in Sydney. “The key difference from those other periods is that this one is started by one person, essentially – being the US president.”

From major banks to blue-chip miners, nearly every corner of the ASX felt the sting. Resources, retail, financials, and energy sectors all plunged in unison. Australia’s benchmark index is now down more than 14% from its February highs.

Trade War Fears Take Centre Stage

Last week, Trump unveiled sweeping new tariffs on imports, immediately prompting retaliatory measures from China, the European Union, and other major economies. On Monday, China announced 34% tariffs on all U.S. imports—a move that has alarmed investors globally and sent shockwaves through commodity markets.

“The escalation in trade tensions is weighing on markets,” said Omkar Joshi, chief investment officer at Opal Capital Management. “If we have a situation where no one backs down… it gets trickier, and there’s every possibility that we do continue to go lower from here.”

Joshi added that markets had perhaps underestimated Trump’s resolve: “You can almost argue it’s the market’s fault for not believing Trump. He’s actually been pretty transparent about what he wants to do, and the markets haven’t been listening.”

US Markets on Edge

Futures markets in the U.S. are also signalling sharp declines ahead, foreshadowing a potentially chaotic trading week on Wall Street. Analysts are warning of a ripple effect across global markets if the trade hostilities intensify.

Tony Sycamore, a market analyst at IG Australia, said the situation is fast approaching a tipping point.

“China’s retaliatory tariffs sparked fears of a full-blown trade war, imminent recession and a liquidity crunch last seen during the early pandemic,” he said. “The door for negotiation remains open, but there’s a real risk that relief may come too late.”

Resources Sector Sees Slim Gains

Amid the carnage, a few bright spots did emerge. Companies involved in critical minerals, such as Lynas Rare Earths, bucked the broader trend to post gains. Investors are betting that China’s export controls on key minerals will boost global demand for non-Chinese supply, especially in sectors tied to clean energy and advanced technologies.

Still, such gains were the exception, not the rule, as red dominated trading screens across the ASX.

Australian Dollar Sinks to Pandemic Lows

The market rout also hammered the Australian dollar, which fell to its lowest level against the U.S. dollar since the height of the COVID-19 pandemic. By Monday afternoon, one Australian dollar was buying just over 60 U.S. cents, down from 64 U.S. cents mid-last week. Earlier in the day, it had dipped as low as 59.64 cents—a level last seen in April 2020.

The Aussie also hit new lows in other major currencies: just 54.4 Euro cents and 46.2 British pence at its nadir.

The sell-off extended to Asian markets as well. The Australian dollar fell sharply in Vietnam, India, Indonesia, and New Zealand. In Vietnam, it dropped below 15,500 dong, compared to nearly 16,500 dong just days earlier.

“When there is concern about a global slowdown, and particularly from the tariff and global trade war, then there is less demand for our commodity,” explained AMP economist My Bui, citing iron ore—Australia’s largest export—as a key vulnerability.

Impact on Consumers, Travellers and Superannuation

The financial hit isn’t just limited to traders. Everyday Australians are likely to feel the effects through their superannuation funds, which are heavily invested in the local share market. With over $100 billion wiped out in a single session, portfolio values are expected to shrink significantly in the near term.

Consumers, too, will feel the squeeze. The falling dollar makes imported goods more expensive, affecting prices for electronics, vehicles, and other household items. Travellers heading overseas will find their budgets stretched as foreign exchange rates worsen.

What’s Next?

With global financial markets now on high alert, all eyes will be on policymakers and central banks. Economists warn that if the tit-for-tat tariff war continues to spiral, central banks may have little choice but to revise economic forecasts and monetary policy outlooks.

“This is a fast-moving situation,” said Sycamore. “What happens in the next few days—and how world leaders respond—could determine whether we’re heading into a deep downturn or whether diplomacy prevails.”

For now, investors are bracing for more volatility, and the once-bullish outlook for 2025 has been clouded by geopolitical uncertainty.

A Test for the Australian Economy

Australia’s reliance on international trade—especially with China—leaves it particularly exposed. While the country has shown resilience through past downturns, the potential for a prolonged global slowdown could put pressure on everything from job creation to inflation and consumer confidence.

As the world waits for the next move in this escalating trade standoff, Australian markets may continue to bear the brunt. And for the first time in years, comparisons to past financial crises don’t seem like exaggeration—they feel uncomfortably accurate.